Are you out of work and uninsured workers in United States? Do you need health coverage and want to know where to get free care for jobless employee like you?

In today’s economic crisis, one of the most important issues for laid-offs, besides loss of paycheck, is health insurance. It’s important to have, but it also comes at a high price. Jobless claims are increasing and you cannot meet the expense to cover your medical problems. If you are employed, you possibly get insurance coverage but if you are unemployed, you will have to find other ways to get adequately insured.

How to Get Health Insurance When You are Unemployed

So if you are concerned to get free medicine or drugs for your health treatment, here’s how to get it.

- Plenty of information is available on the Internet so learn options for getting health insurance. You can also find information at your local unemployment office.

- Explore COBRA (Consolidated Omnibus Budget Reconciliation Act), a federal law that provides eligible individuals and their dependents with the ability to continue health insurance benefits during periods of unemployment.

- Check out your state’s coverage policy. You may meet the criteria for continuation of coverage depending on your earlier job.

- Search for individual health coverage options on the Internet. Based on the state you reside in, you may meet the requirements for cheap individual health plan when unemployed.

- Speak to a health insurance agent and seek advice on the most appropriate coverage while unemployed.

- Check out HIPAA (Health Insurance Portability and Accountability Act) of 1996 that permits insurance for some individuals who lose group coverage. It has a separate method of charging the premium and provides coverage for at least two health insurance policies that do not oblige a pre-existing medical condition exclusion period. Ask if you are eligible, as it would also depend on your COBRA coverage wherein you must have used up to eighteen months of COBRA in order to qualify.

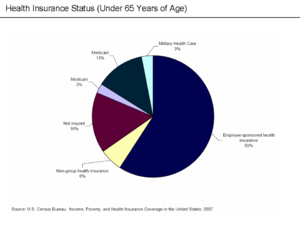

- See if you qualify for Medicaid. If you are disabled, above 65 years of age or if you are a woman and pregnant, you may qualify for Medicaid. It offers cheap insurance for people with low income families. You can contact Medicaid directly by visiting their official website.

- Get in touch with some of the pharmaceutical companies that manufacture drugs as they have certain programs for individuals who are uninsured. The financial assistance is limited to the cost of medication and do not include hospital visit or doctor expenses.

These are just few tips, there are so many other resources that you can collect from to get the money you need. This involves non-profit organizations that are ready to help you cover medical expenses.

Other Health Insurance Plans Offered By Many States

Many states now provide high-risk pools which make health care available for people who are not eligible for getting health insurance coverage.

These programs help certain uninsurable individuals to obtain health insurance coverage. The eligible people may include those who have been rejected by other health insurers or have had health insurance benefits reduced or certain medical conditions excluded. It may also include individuals who have a qualifying health condition or have been unwillingly terminated from another health insurance plan. Based on the availability of funds, enrollment is limited in some states. Because of the limited enrollments, it has become necessary to establish waiting lists. Other states provide options of converting a group health plan to a non group policy. The conversion policy in most of the cases is expensive but the primary advantage of choosing a conversion policy is that a person cannot be rejected for coverage and it may not include a new pre-existing condition exclusion period. These law governing conversion policies can also vary from state to state so it’s better to contact state insurance commissioner’s office for any additional information.

Maintaining Health Insurance during Termination

You have limited time to decide on health care options. It’s important to review and explore all the options carefully for maintaining coverage as soon as possible after your employment terminates.