Unemployment Insurance (UI) benefits are available to individuals who lost their jobs through no fault of their own. The claimants must meet monetary eligibility criteria when applying for UI benefits, one such being the base period. Know what is a base period and calculate your UI benefit amount using our base period calculator for unemployment.

What is the Base Period?

Typically, the base period or base year is the period of employment before losing the job. In the majority of the states, the base period is typically 12 months. It consists of the first four of the last five quarters of the calendar year before filing the claim.

What is a quarter? How many months are there in one?

A calendar year is divided into four quarters. A calendar quarter is a three-month period into which the financial year is divided. The four quarters of a year are:

Quarter1: January, February, and March

Quarter2: April, May, and June

Quarter3: July, August, and September

Quarter4: October, November, and December

The base period determines not only the monetary eligibility but also the benefit amount a claimant is entitled. For the base period to be valid, the employer should be covered or insured.

There are two types of base periods – Standard Base Period and Alternative Base Period.

What is the Standard Base Period?

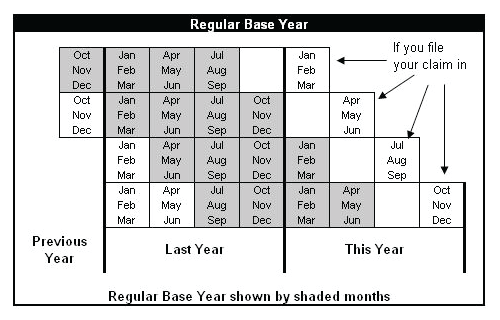

The Standard Base Period is the most common type of base period and is in effect in all the states. It comprises the first four of the last five completed calendar quarters preceding a UI claim’s starting date.

How to find Standard Base Period?

If a claim is filed anytime between January to March 2020, the base period will be 12 months from October 1, 2018, through September 30, 2019.

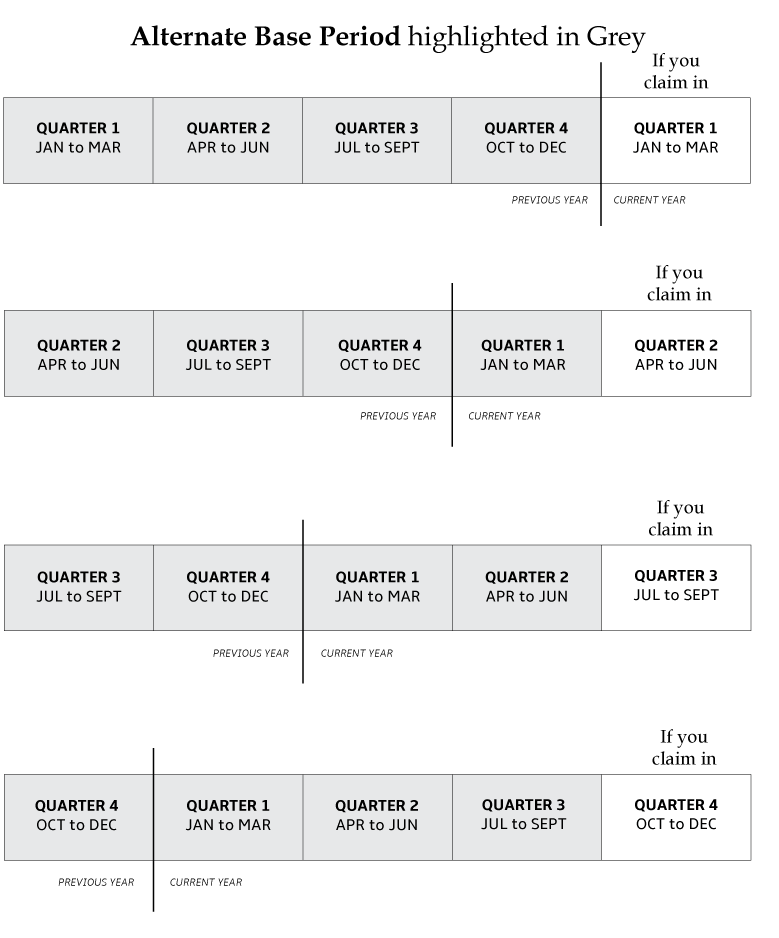

What is the Alternative or Alternate Base Period?

If the claimant does not have sufficient wages in the Standard Base Period, the authorities will qualify the claimant for UI benefits through the Alternative Base Period. The Alternative Base Period for unemployment benefits is the last four completed calendar quarters preceding the starting date of the claim. Additional information such as most recent quarterly earnings, proof of wages earned in the form of pay stubs, and verification of earned wages may be asked for in case of the Alternate Base Period.

This type of base period is not adopted in all the states and is in effect in 39 states as of 2018.

How to find Alternate Base Period?

If a claim is filed anytime between January to March 2020, the alternate base period will be 12 months from January 1, 2019, to December 31, 2019.

What happens if the claimant had multiple jobs during the base period?

If a claimant has worked in more than one job during the base period, the authorities will determine the primary and the subsidiary job by comparing the factors such as hours, wages, and employment history. Although wages from all jobs are used to calculate monetary eligibility, a claimant is eligible for UI benefits only upon the loss of a primary job.

If a claimant leaves a subsidiary part-time job before eight weeks before the establishment of an eligible claim, the UI benefits are subject to a constructive deduction.

How to file interstate & multi-state claims?

If the claimant has worked in one state previously and is now living in another state, then he/she should meet the state standard to file for UI benefits in the state where the claimant has worked. The claim can be filed either through online portals or by phone, depending on the state’s procedure.

If the claimant has worked in multiple states, then he/she can select and file a claim in any one of the states. The select state will then contact other work-states of the claimant and collect wage information to calculate the base period.

How to file for UI benefits if the claimant is relocating to another state?

If the claimant is moving to another state in search of employment, then he/she can file a claim through an online portal for 2 consecutive weeks. During the process, the new location must be shared to avoid any delay or denial. The claim must then be transferred to the new state.

Base period calculations vary with states. If you’re unaware of the criteria used for base period calculations in your state, contact your local state unemployment authorities. If you meet the criteria, proceed to calculate your base period wages using the base period calculator.