The 1099 form is used to record income that you have received as an independent contractor or through other sources of income. This would mean that if you are a freelancer then you will receive 1099 forms from your clients. The IRS requires businesses to issue this form if contractors are paid at least $600 in the same year.

Based on how you receive your income, there are a few different 1099 forms that will need to submit. The 1099-K form is used for payments via settlements entities like PayPal that record business transactions for that particular year. Finally, you should track the sum total of your 1099 forms and calculate the total income and adjusted gross income (AGI).

What is a 1099?

A 1099 form is a tax form used in the United States to report various types of income received by an individual or business that is not considered traditional employment income. The 1099 form is used to report income earned from freelance work, contract work, rental income, or any other source of income that is not subject to traditional payroll taxes.

There are several types of 1099 forms, each designated for a different type of income. Some common types of 1099 forms include:

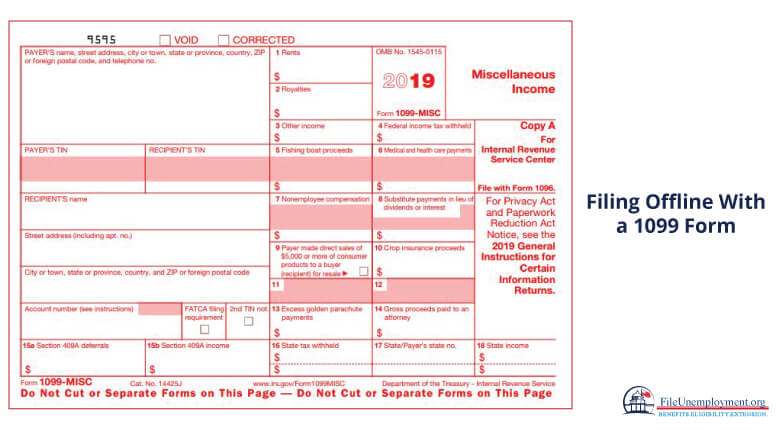

- 1099-MISC: Used to report miscellaneous income, such as payments for freelance or contract work

- 1099-INT: Used to report interest income received from banks, savings accounts, or other financial institutions

- 1099-DIV: Used to report dividend income received from stocks or mutual funds

- 1099-R: Used to report distributions from pensions, annuities, or retirement accounts

- 1099-K: Used to report payment card and third-party network transactions

- 1099-NEC: Used in the United States to report non-employee compensation paid to individuals or businesses

- 1099-G: Used to report unemployment compensation or state or local income tax refunds that you have received in the same year

It is important to note that if you receive a 1099 form, you are responsible for reporting that income on your tax return and paying any taxes owed on that income.

But the one that is most frequently used is the Form 1099-MISC used by independent contractors and business owners.

When is the Deadline for 1099?

You should ensure that you file form 1099-MISC with the IRS every year by January 31. On the other hand, Form 1099-K should be filed with the IRS by February 28 for mail filing and by March 31 if you are submitting it in the electronic form.

How to Go About Filing 1099 Form?

Paper Filing

When it comes to compiling the 1099 form, you should ensure that you include Copy A of 1099-MISC and Copy A of the 1099-K when you share the 1099 form with the IRS. Also, ensure that you submit Form 1096 should be filed as well. This helps the IRS check the amount you paid out in total. These IRS forms are scanned to electronically read these forms.

Electronic Filing

When it comes to the electronic filing, you need to use a special formatting software which is usually worked on by developers. Anyone that files online should apply to the IRS to let them know that you are filing electronically. Moreover, the IRS prefers this method and there are major benefits like:

- Filing for State and Federal together for 34 states

- No 1096 form needed

- Submission of 1099s in Bulk

- Form confirmation of it being received and processed.

Preparing the 1099 Forms

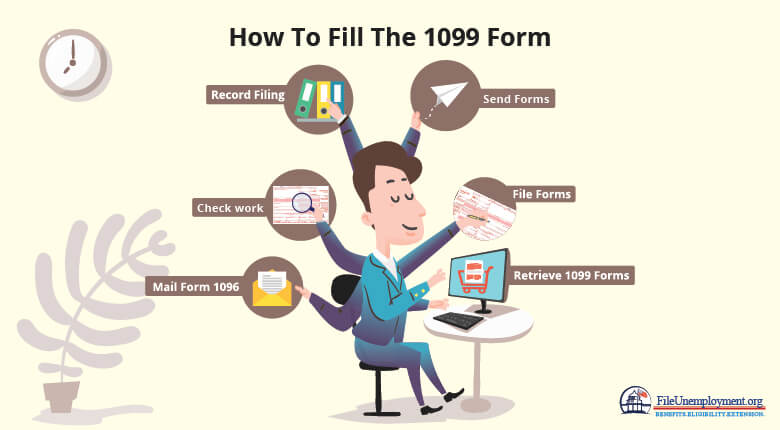

The following seven steps will help you prepare your 1099 forms and adhere to the IRS guidelines:

1. Reviewing Your Work

You should ensure that you start the 1099 form process by filling in the correct information of the contractors. Ensure that you have filled out the Form W-9 for each contractor. This would include information like their name, address, and their Social Security Number (SSN) or Employer Identification Number (EIN).

As a good practice, you should check with each contractor to see if any information has changed prior to when you started the 1099 filing process. Check whether all contractors have provided the W-9 forms and whether they have omitted specific information. Based on this, you can withhold 28% of the contractor’s pay and send this directly to the IRS.

2. Getting Your 1099s in Order

When it comes to the 1099s, you should ensure that you have accurate information to work with. Ensure that you do not use a downloaded Form 1099-MISC or a sample, as these forms will be read by the IRS scanner when it processes these forms.

Order these forms directly from the IRS from their website or call 1-800-TAX-FORM (1-800-829-3676). Alternatively, you can get these forms at office-supply stores or file it online. You should know that you can buy pre-printed 1099 forms that let you print all of the information to the corresponding sections of the 1099 form.

Use the IRS Form 1099-MISC to determine the incomes for all non-employee compensation. This is what independent contractors use file and calculate their taxes. Ensure that all contractors that you have paid more than $600 in the same year fill in the Form 1099-MISC. This form is to be filled in by contractors that work for partnerships and LLCs throughout the year.

When it comes to the paper filings, Form 1096 is attached along with the 1099 filing, wherein you report the total amount of the 1099 payments that you have filed. This ensures that the IRS has the cumulative forms add up to how much is paid out in total as reported in the 1096 form.

If you get a Form 1099-G from the government agency then you are required to report this information when filing your tax return. Usually, the 1099-G is used to report unemployment compensation or state or local income tax refunds that you have received in the same year.

3. Filling Out Forms

Once you have the details and information of your contractors and the forms, you then need to put pen to paper and fill them out. You can begin with entering the Federal Tax ID number which is the SSN or EIN and then add the contact information.

The 1099 form should include the total amount of money paid to the contractor which is entered in the title Non-employee compensation. In case, you had withheld any pay from the contractor then you need to fill in details in relation to federal or state income tax which was withheld.

Finally, you need to enter the contact information forms and repeat this for each contractor that you have worked with.

4. Sending Out the Forms

You should then proceed to send the forms to the IRS. Either, you should mail or hand each of 1099 Copy B to the contractor before February 1. If you fail to meet this deadline then there would be an IRS penalty fee that would be levied on you.

5. Mailing Form 1096 to the IRS

IRS Form 1096 sums up the total of your returns which would be the 1099s. In case you file through snail mail then you must mail Form 1096 and Copy A of each Form 1099 to the IRS before February 29. But, if you are filing electronically, then you can send it out by March 31.

6. Keeping Record of Your Filing

Always keep a Copy C for your own records in case there are questions regarding the information that is sent to the IRS.

What’s the IRS Penalty for Missing the Deadline?

If you miss the deadline, then the penalty would range from $30 to $100 based on the form. You will be fined a maximum of $500,000 per year. In case a company completely disregards the need to showcase correct statements, then it could be fined $250 per form with no maximum limit.

What’s the Difference Between a 1099 and a W-2 Tax Form?

Although the W-2 and Form 1099 are both used to report income that you earned from sources throughout the year. They are issued under different circumstances and requires different approaches when it comes to tax planning.

So, what is a W-2 Form?

A W-2 Form is usually given to you if you are an employee. Here, the IRS requires you to record your salary and tax information and file it with a W-2 form. This form shows you how much money you have earned from the employer during the year and you can thus calculate your AGI which includes your Federal and State taxes.

Here you can determine how 1099 forms differ from W-2 forms:

- Here taxes are not usually withheld by the payer.

- If you are a freelancer, then you are required to estimate your taxes and pay self-employment tax.

- Here, you would not be withholding taxes on payments by doing tax payments quarterly based on your estimated annual tax liability.

- The 1099 form will not show the taxes that you have paid to the government but the income you get from each client.

What’s the Difference Between a 1099-K and a 1099-NEC?

The main difference between Form 1099-MISC and Form 1099-NEC is the type of income they report. Form 1099-MISC is used to report various types of income that are not considered wages, salaries, or tips. It is typically used to report payments made to non-employees such as independent contractors, freelancers, and other service providers.

1099-MISC was previously used to report non-employee compensation, but that section has been moved to Form 1099-NEC.

Form 1099-NEC, on the other hand, is specifically used to report non-employee compensation. This form is used to report payments made to independent contractors, freelancers, and other non-employees for services performed for the business.

Another difference between the two forms is the deadline for filing. Form 1099-MISC is due to recipients by January 31 and must be filed with the IRS by the end of February (or the end of March if filing electronically). Form 1099-NEC must be provided to recipients and filed with the IRS by January 31.

It’s important to note that if you are a business owner or self-employed individual, it’s important to understand which form you are required to file based on the types of payments made or received. Failure to file the appropriate forms or report income accurately could result in penalties or other consequences from the IRS.

Comments are closed.