Estimate Your Base Period Using this Tool:

Select your filing month and year:[unemp_base_period]

Your Base Period is:

The base period in a broader sense is the period of employment prior to losing the job. It is also referred to as base year. The base period is generally the first four of the last five completed calendar quarters prior to the effective date of the claim/unemployment. So what is a calendar quarter? Every calendar year is divided into four parts, known as “quarters”. Here are the 4 calendar quarters –

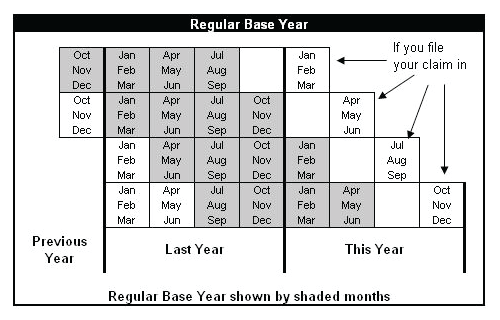

Coming to the Base Period, if the unemployment claim is filed in January, February or March of 2013, then the base period is October 2011 through September 2012.

Although the base period is defined by state unemployment agencies, the following chart explains a definition adopted by many states.

For the base period to be considered valid, the employment should be covered or insured. Covered / Insured Employment is when the employer would have contributed unemployment insurance taxes to the government. These taxes aid a worker while unemployed.

Base period helps determine the monetary eligibility, where the recipient should have earned a minimum amount in the base period to qualify for unemployment benefits. It also determines the amount of benefits a person is entitled to.

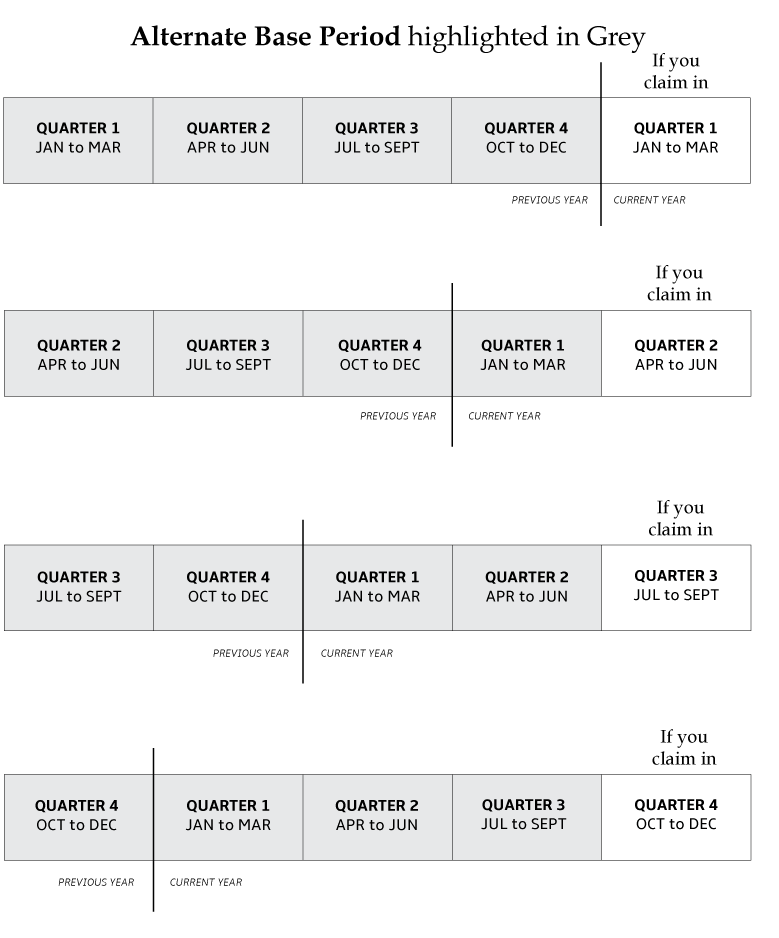

What happens if you have not worked for more than a year? You may qualify for the alternate base period. An alternate base period is the last four calendar quarters prior to unemployment. The alternate base period is not something you can choose to use. It can be used only if you cannot establish monetary entitlement using your wages in the traditional base period. This means, if you have not earned sufficient wages during your traditional base period, the state government will apply the alternate base period to the claim to determine monetary eligibility. Additional information like most recent quarter earning, proof of wages earned in the form of pay stubs and verification of wages earned during the quarter from your employer may be asked for in case of the alternate base period. Here’s a chart explaining alternate base period –

Contact your local state unemployment office to find out the exact criteria used for base period calculations before filing for unemployment. Some states are flexible with base period requirements and allow you to “borrow” from quarters outside of base period if you do not have enough credits.

If you are looking to file for unemployment benefits, please refer to the guides on the side menu or state-specific pages.

Comments are closed.