Identity theft and identity fraud are terms used to refer to all types of crime in which someone wrongfully obtains and uses another person’s personal data in some way that involves fraud or deception, typically for economic gain. Unlike fingerprints, which are unique and cannot be given to someone else for their use, personal data especially Social Security number, bank account or credit card number, telephone calling card number, and other valuable identifying data can be used, if they fall into the wrong hands.

In the United States and Canada, for example, many people have reported that unauthorized persons have taken funds out of their bank or financial accounts, or, in the worst cases, taken over their identities altogether, incurring huge debts and committing crimes while using the victim’s names.

In many cases, a victim’s losses may include not only out-of-pocket financial losses but substantial additional financial costs associated with trying to restore his reputation in the community and correcting the erroneous information for which the criminal is responsible.

Rise and impact of identity theft on businesses and individuals

According to the reports of the US Department of Justice released in 2010, an average of 193 federal cases of cyber crimes was prosecuted by the Department of Justice. The US Sentencing Commission is in the process of bringing out its annual report of 2016 which will reflect the number of victims of Cyber Crimes between 2015 and 2016.

Americans have been victims and suffered harm as a result of the theft of their identity in the last twelve months. Furthermore, the agency also released a commission report detailing its identity theft program since its inception. The survey found that within a period of one year, 2.28 million consumers discovered that new accounts had been opened and other fraudulent activities such as renting an apartment or home, obtaining medical care or employment, had been committed in their name.

In those cases, the victims were categorized as follows: 2.28% Existing Credit Card Account Fraud, 1.15% Existing Non-Credit Cards Accounts Fraud, and 0.83% new accounts and other Fraud, with a mean fraud loss of $ 5,803 per victim. Existing Credit Card Accounts fraud is the least costly classification, while New Accounts and other Frauds with a mean loss of $ 12,646 is the most serious category. Existing Non-Credit Card Accounts fraud, which includes existing credit and saving accounts, is the mid-range classification with a mean loss of $ 9.912.

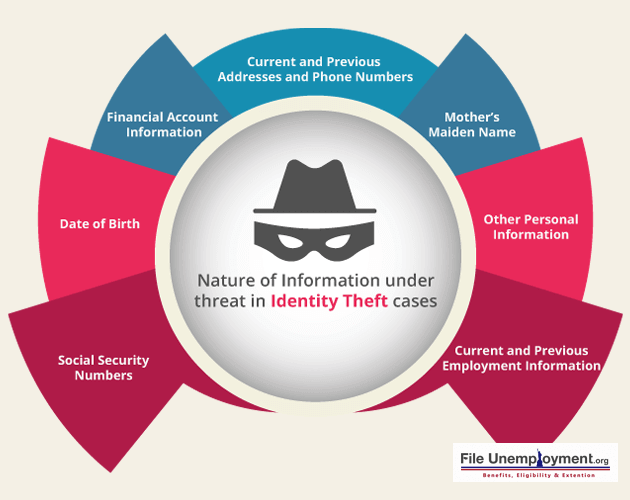

Nature of Information under threat in identity theft cases

In the cyberspace, identity thieves are looking for sensitive personal information, and there are many pieces of information that could be utilized. Some of the most common are:

- Social Security Numbers (SSN): This number was created to keep an accurate record of earnings and pay retirement benefits on those earnings.

- Date of Birth (DOB): Date of birth, in conjunction with other pieces of information, can be used in many ways to compromise a person’s identity.

- Current and Previous Addresses and Phone Numbers: Both can be used in cybercrime and identity theft to enable an offender to assume the identity of the victim or to obtain more information thereabout.

- Current and Previous Employment Information: Such information can be used to jeopardize the victim’s identity.

- Financial Account Information: This includes checking and savings accounts, credit cards, debit cards, and financial planning information. Such information is a rich source for an identity thief to commit financial cybercrimes.

- Mother’s Maiden Name: In many instances, the maiden name of the victim’s mother may be used as the password for financial accounts and is easily available through public record information.

- Other Personal Information: This includes passwords, passcodes, email addresses as well as photos. Such information could be utilized to obtain access to other sensitive information or to facilitate total or partial identity theft.

Tackling the Menace of Identity Theft: Technological Perspectives

Anyone who is concerned with the possibility of identity theft should adopt techniques designed to stop these kinds of crimes before they happen. A great deal of information about identity theft prevention is available from trustworthy sources, such as state attorneys general offices, the United States Department of Justice, and local consumer protection agencies.

Among the most effective strategies to avoid becoming a victim include conducting regularly scheduled credit report reviews, using online passwords that are unique and difficult to guess, shredding financial documents before throwing them away, and sending and receiving mail using a secure mailbox.

Taking the recommended precautions is no guarantee against identity theft, however. One of the best ways for people to minimize the loss in the event they are victimized is to learn to recognize the signs that a crime has occurred. Unfamiliar entries on credit reports are a strong indication of identity theft. Other signs include bills arriving in the mail addressed to someone else, a sudden increase in pre-approved credit offers, and unexpected telephone calls from debt collectors. It is important to quickly follow up on such occurrences to determine their cause. Those who suspect an identity crime is being committed should immediately report the incident to the appropriate credit agencies and law enforcement officials.

Prevention and Regulation of Identity Theft: Legal Perspectives

Identity theft is generally tackled and regulated in the US through the Identity Theft and Assumption Deterrence Act, 1988. It has been able to achieve four main objectives:

- It made identity theft a separate crime against the individual whose identity was stolen and credit destroyed. Previously, victims had been defined solely by financial loss and often the emphasis was on banks and other financial institutions, rather than on individuals.

- It established the Federal Trade Commission (FTC) as the Federal Government’s one central point of contact for reporting instances of identity theft by creating the Identity Theft Data Clearing House.

- It increased criminal penalties for identity theft and fraud. Specifically, the crime now carries a maximum penalty of 15 years imprisonment and substantial fines.

- It closed legal loopholes, which previously had made it a crime to produce or possess false identity documents but not to steal another person’s personal information.

Identity theft, therefore, remains a big threat for individuals and businesses in the 21st century which can be prevented effectively by taking the precautionary measures mentioned above. However, the perspective of law enforcement to prevent identity theft still remains a grey area as the US Department of Justice has struggled in the last 15 years to adopt counter-measures to tackle this issue. All measures adopted so far have been reactive rather than proactive. Thus, it remains to be seen what measures are adopted in the next 20 years to deal with this menace both from the technological and legal perspectives.