Bankruptcy is for losers, right? Wrong. In fact (harsh as it may sound) it might be more accurate to say that those who don’t file for bankruptcy are the losers. Not because they’re bad people, but because they can’t win against interest.

The sad truth is that if you borrow more than you can pay back, you will be buried under interest payments. What bankruptcy really does is provide you with a fresh start by wiping away your previous debts – with certain exceptions. In fact, several very wealthy and successful people have filed for bankruptcy as a financial strategy to cut their losses and move forward. Sometimes these bankruptcy filers reached even greater heights of fame and finance than they did before.

7 People Who Became Crazy Rich After Bankruptcy

George Foreman

Photo courtesy of Gage Skidmore

George Foreman was not always a grilling machine. George is known today for selling his patented George Foreman grill, touting its benefits in commercials and infomercials. But before Foreman was an entrepreneur, he was a boxer. George Foreman was actually down and out after losing $5 million that he had accrued in his fighting career. He continued to box well into his 40s in order to chase these losses, but that was a poor decision that cost him his health. Finally, George made a smarter move and declared bankruptcy, so he could pivot away from chasing the past and embrace a sizzling entrepreneurial future.

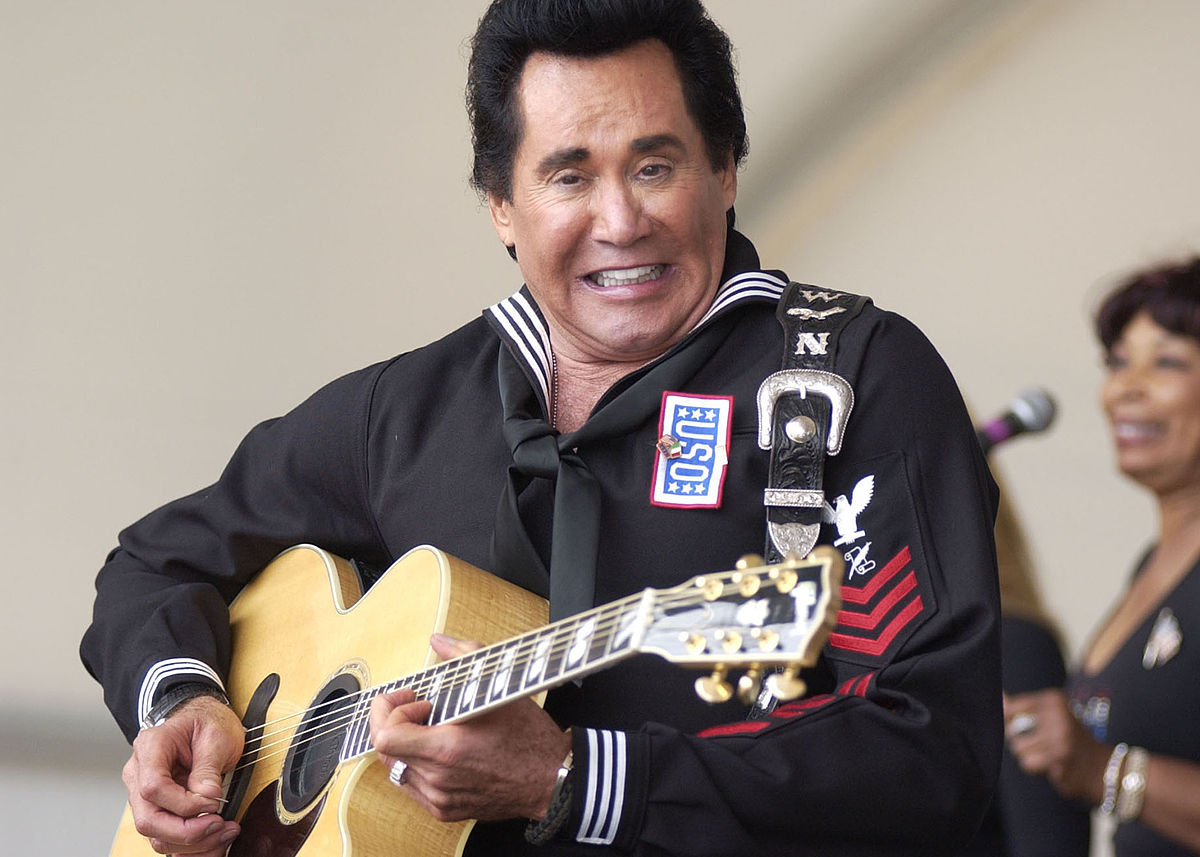

Wayne Newton

Wayne Newton was long one of the biggest names in Las Vegas, performing nightly for over 40 years. Unlike some entertainers, Wayne did not fritter away his earnings on cars, mansions, and parties. He purchased investments, but these purchases were sometimes paired with leverage (that is, debt). Unfortunately, the tax end of Wayne’s investments was not so well managed, and he found himself facing an insurmountable bill from the IRS.

Coupled with a lawsuit against NBC, Wayne’s debt snowballed to $20 million. Within less than a decade after declaring bankruptcy, Wayne had rebuilt his fortune and his reputation, continuing to light up the billboards of the Las Vegas Strip.

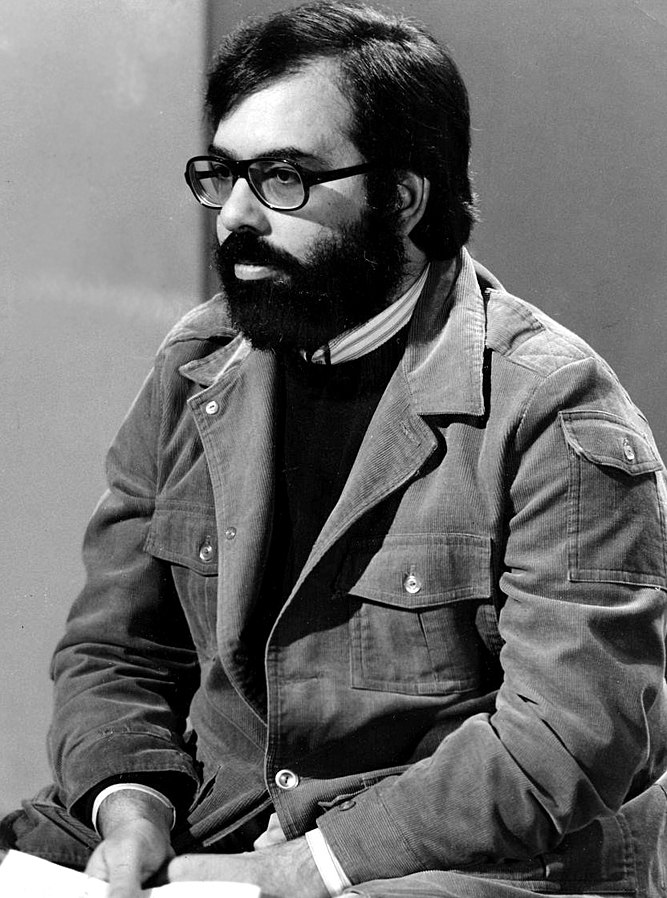

Francis Ford Coppola

Francis Ford is a world-renowned filmmaker known for classics like the Godfather. But not every invention is a success, and not every film is a smashing box office hit. After a run of unsuccessful films, Coppola ended up with almost $100 million in debts, with only half that amount in assets. As a result, he had to file for a Chapter 11 bankruptcy to reorganize his film business. But using this strategy to cut deals with his investors and creditors allowed Coppola to stay in business, and he went on to make several successful films that made up for his previous failures.

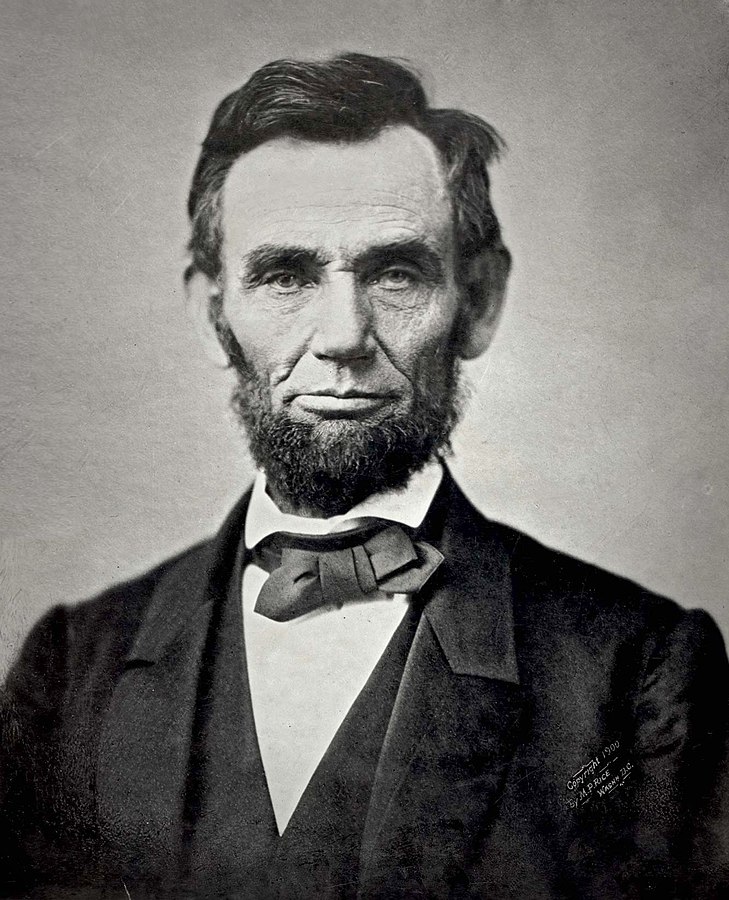

Abraham Lincoln

The President who held this house together once filed for bankruptcy before his tenure in the White House. Abraham Lincoln owed around $1,000 (in today’s terms, approximately $30,000) when a business partner died after a failed joint shopkeeping venture. The general store they had opened in Salem, Illinois did just not work out. This story is a great illustration that those cut out for leadership are not always cut out for business. It was this failed business venture that prompted Abe to get into politics…and the rest is history.

Walt Disney

Walt Disney began as the quintessential Renaissance Man, dabbling in everything, and succeeding at nothing. He tried his hand at animation for a number of years, but one particular movie deal fell through when an investor in the film filed for bankruptcy, putting him in hot water with creditors. But just a few years later Walt created Mickey Mouse, the star of Steamboat Willie. It was the bankruptcy that forced Walt to reorganize his finances, his studio, and his goals, which led to the creation of Mickey Mouse. From this modest animated short, Walt would go on to build one of the largest media empires of all time.

Donald Trump

The 45th President of the United States is certainly a polarizing figure, but he has long been acknowledged as an outspoken face of the world of business and real estate. Trump’s businesses have filed for bankruptcy four times. This type of corporate bankruptcy, Chapter 11, is much different than the Chapter 7 or Chapter 13 bankruptcy that your average consumer would file for. One key difference is that it allows the companies to cut deals with their creditors so they can reorganize and move forward.

The subject of the Trump bankruptcies was the Atlantic City casino empire he built in the 1990s. However, as Trump was filing corporate bankruptcies, he was able to retain his personal assets, a strategy that has been used by everyone who wisely separated their personal assets from their business via the likes of an LLC or corporation.

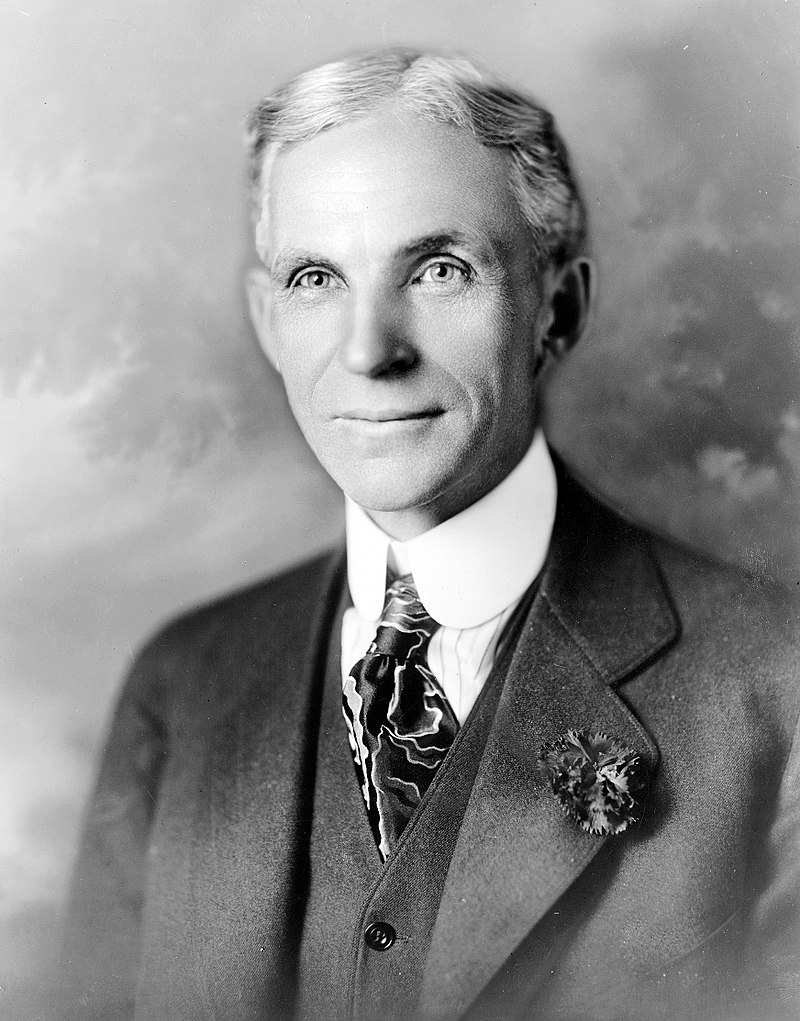

Henry Ford

“You can have any color you like, as long as it’s black.” These words, attributed to Henry Ford, summarize the story of how he invented the modern automobile industry with the assembly line. But before creating Ford Motors, Ford created the utter failure of The Detroit Automobile Company in 1899. Ford was working on the cars himself, which left him little time or energy to manage the business. The unfortunate result is that he was unable to pay his investors and had to file for bankruptcy. Ford created a second car company in 1901, which again led to filing for bankruptcy for some of the same reasons. Henry Ford finally learned his lesson and in 1903 created the Ford Motor Company, which remains one of the largest carmakers in America.

Overwhelmed by debt? You are not alone

It’s not the end of the story if you feel like your debt is insurmountable. Bankruptcy is not a legal tool used exclusively by debtors with no hope and nothing going on in their life. Rather, it is a legal tool that has been used by some very rich and famous people to reorganize their finances or cut their losses so they can move on.

Successful people in every area – real estate, finance, politics, entertainment, and sports, to name a few – have filed for bankruptcy so they can move on towards new goals. In some cases, filing for bankruptcy forced them into restructuring much more than their finances. They went on to establish new businesses and new careers, bringing the world things that might not have been seen otherwise. But filing for bankruptcy does not have to be so lofty. For the average consumer, it is the best way and only way to escape from underneath a mountain of interest-bearing debt. Bankruptcy is not an ending to your personal finance journey, but rather a new beginning.