Home builders are very worried about a recent survey released by John Burns Real Estate Consulting. Now builders are canceling home construction and slashing jobs as the market for new construction cools down – prompting some home builders to embrace the message of “hoard your cash and hang on to hardhats.” The survey was conducted with 320 participants in over 84 different metro areas around the country, with its results suggesting that the homebuilding industry doesn’t have such a great foundation right now.

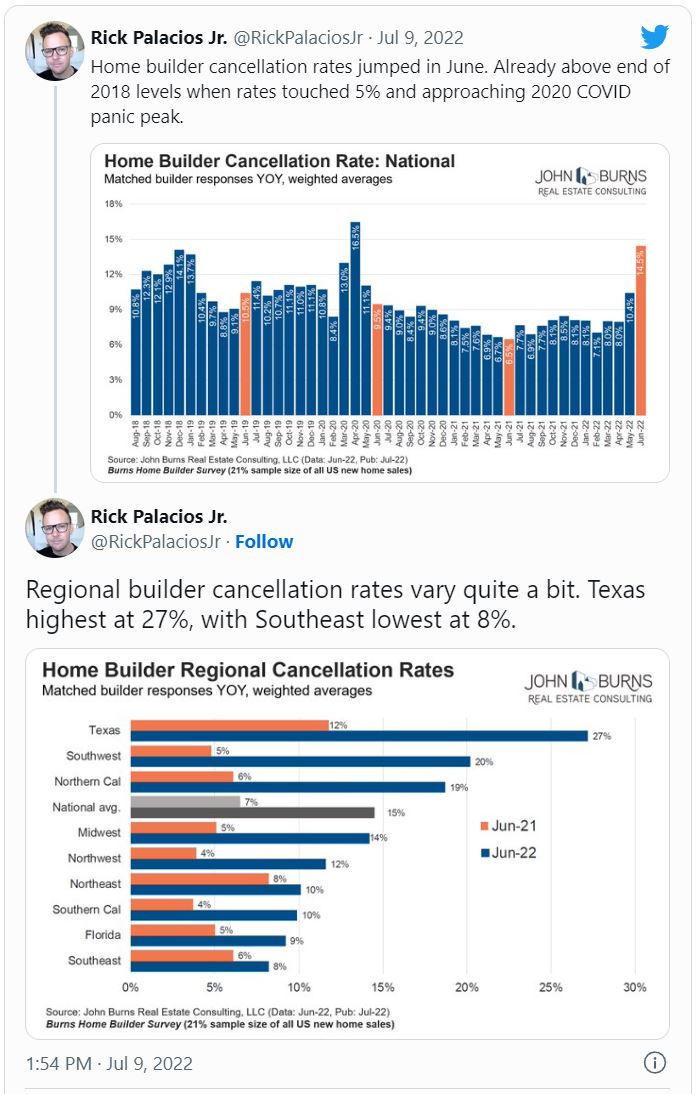

Just take a look at some of the cancellation rates on new homes and compare them to last year. Texas has a 27% cancellation rate, compared to 12% last year. Northern California has a 19% cancellation rate, compared to 6% last year. And the Southwest region has a 20% cancellation rate compared to 5% last year. All of these are above the national average of 15%, which was under 7% last year.

They say when it comes to real estate, everything is about location, location, location. But in the recent housing market – particularly new homes – it might just be about inflation, inflation, inflation.

Homebuilder confidence has dropped every month for the past six months, according to a survey conducted by Wells Fargo and the NAHB – the National Association of Home Builders. Some of this is tied into the old law of supply and demand, and the demand for new home construction is just not there now, because homebuyers have other fish to fry – namely worrying about gas and groceries, before taking on a new mortgage payment.

They say when it comes to real estate, everything is about location, location, location. But in the recent housing market – particularly new homes – it might just be about inflation, inflation, inflation. Inflation has hit a 40-year high recently, with consumer prices increasing more than 9% over the past year. That’s not exactly the type of goal our economy wants to reach, since it means the average consumer is much more strapped for basic necessities, with little room left over for major purchases like a down payment on a new home.

But aside from some homebuyers not having extra cash on hand (have you seen gas prices lately?) you might be wondering why inflation is impacting the entire housing market. Turns out that when money loses its purchasing power, the Federal Reserve tries to fight back by increasing interest rates. That’s why the average contract interest rate on a 30-year mortgage climbed to almost 6% as of this month, up from 3% around a year ago.

Wow! At this point, it’s hard to tell which is increasing faster – the price of gas or the rate on a new mortgage.

With rates like this, consumers just can’t afford to hop out of their old home and into a new mortgage. Heck, with rates like this, even a refinance that would usually make sense, just might not.

There are a few reasons why a buyer might pull out of a home sale, but the most common reason is they just can’t get a mortgage.

It’s reasons like this that have also made the demand for new homes cool down. Way, way, down. After all, if consumers can barely afford to purchase homes that already exist, why should the market become glutted with new home construction?

Within the past year, sales of new homes have dropped by just over 30%. Cancellation rates have jumped to 14.5% from 6.5% – that’s a whopping 123% increase. There are a few reasons why a buyer might pull out of a home sale, but the most common reason is they just can’t get a mortgage. With interest rates doubling in the past year, that’s very understandable.

Of course, this does not bode well for home builders since there is no point in building a home if nobody is going to buy it.

This massive bump in the road for homebuilding is an indicator of rockier travels as America hurtles towards a recession. Currently, 88% of Americans say our country is on the wrong track. The home construction market – like any other market – does not exist in a bubble. It’s tied to the financial industry, it’s tied to raw materials, and it’s tied to nearly every industry.

Layoffs are once again plaguing the job industry. This affects not only those construction workers who always wanted to be Bob the Builder, but a staggering number of Americans who are poised to lose their jobs as we enter a Recession.

And yes, a Recession is inevitable. While Bank of America is looking at the near future with rose-colored glasses, analysts over at Deutsche Bank have forecast a major Recession – the kind of economic period that sees home builders out of work. Companies like Tesla, Netflix, Peloton, and Coinbase have all initiated layoffs.

What does this all have to do with housing prices?

Studies have shown a strong correlation between a decrease in housing prices and an increase in unemployment claims. With the housing market looking so glum, home builders are slashing prices on newly built homes. Where you live, there is a good chance home prices are down – and unemployment is going up.

If you are unemployed or impacted by the upcoming recession, reach out to a benefits advisor today to learn more about free government benefits and financial assistance opportunities.