The Indiana unemployment calculator is a handy tool for estimating how much you could receive in unemployment benefits.

In Indiana, the amount you are paid depends on your work history and previous income. By using this calculator, you can get a good idea of your potential weekly benefit amount during a period of unemployment.

Indiana Unemployment Benefits Calculator

How is Indiana unemployment compensation calculated?

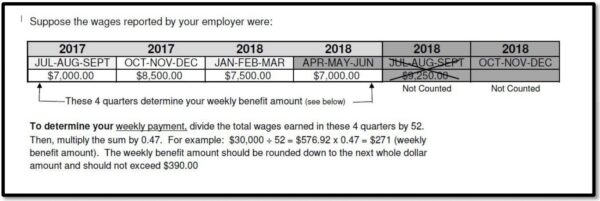

Your weekly benefit amount (WBA) is based on the wages you earned during your base period, which is the first four of the last five completed calendar quarters before you applied for UI benefits. In Indiana, the maximum weekly benefit you can receive is $390.

Determine your weekly benefit amount by dividing your total base period wages by 52. Then multiply that number by 0.47. The final amount should be rounded down to the nearest whole dollar.

For example, if your total wages in the base period added to $40,000, then your WBA would be:

$40,000.00 ÷ 52 = $769.23 × 0.47 = $361.00 (rounded down to the nearest dollar)

With base period wages of $40,000, your weekly benefit amount would be $361 per week.

For example:

- If you make $300 per week in Indiana, your estimated weekly benefit is $141 for up to 26 weeks.

- If you make $400 per week in Indiana, your estimated weekly benefit is $188 for up to 26 weeks.

- If you make $600 per week in Indiana, your estimated weekly benefit is $282 for up to 26 weeks.

- If you make $1000 per week in Indiana, your estimated weekly benefit is $390 for up to 26 weeks.

- If you make $1200 per week in Indiana, your estimated weekly benefit is $390 for up to 26 weeks.

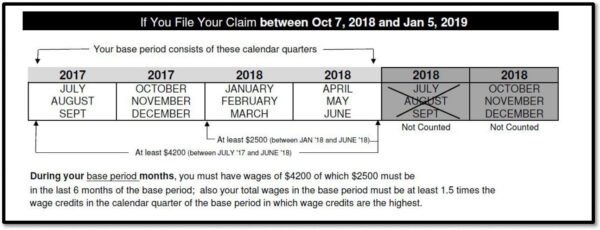

Understanding the Base Period

The base period is the first four out of the five most recently completed calendar quarters before you file your initial claim for a new benefit year. Any earnings from the most recent quarter, known as the “lag quarter,” are not included in these calculations.

The money you earned in your base period is used to both assess your eligibility for benefits and calculate the amount you could receive.

To qualify for Indiana unemployment insurance, you must meet two financial criteria based on your base period earnings. First, the total wages you earned during your base period must be at least 1.5 times the wages you earned in the quarter where you made the most money. Second, you must have earned at least $4,200 in total during the base period, with a minimum of $2,500 of that amount earned in the last six months of the base period.

How long do benefits last?

You can collect regular unemployment insurance for up to 26 weeks or until you hit your maximum benefit amount.

What is the maximum benefit amount?

The maximum benefit amount is calculated by multiplying your weekly benefit amount by 26. This amount will be displayed on your Monetary Determination of Eligibility, which is provided after applying for Indiana unemployment benefits.

In times of high unemployment, you might be able to get an emergency unemployment extension that lengthens the time you can receive benefits.

Deductions

Certain factors can affect your weekly benefit amount. Child support, pensions, and other income can result in a decreased payment.

Child support

If you owe child support and have a Title IV-D case, federal law mandates that the state withhold money from your Indiana unemployment benefits. Up to 50% of your weekly benefit amount could be taken to cover both current and past-due child support payments.

Pensions, severance pay, & annuities

In Indiana, if you get severance pay when leaving a job, that amount will reduce your unemployment benefits. Similarly, if you receive money from a pension, retirement, or annuity plan, that income will be directly deducted from your weekly unemployment benefit.

However, you won’t face deductions if your employer is the sole contributor to your pension, retirement, or annuity plan.

Exceptions can be made if you’re facing extreme financial difficulties due to unexpected emergencies beyond your control. In such cases, pension deductions might be waived.

How partial benefits are calculated

If you work while receiving unemployment benefits, any money you earn above $100 will reduce your weekly benefit payment on a dollar-for-dollar basis.

Example: Let’s say your WBA is $300.00. You earn $150.00 one week working. Since your earnings are more than $100.00, your weekly benefit amount will be reduced by the amount that is over $100.

$300 – $50 = $250

Since $150.00 minus $100.00 is $50.00, your payable amount will be $250 ($300 minus the $50.00).

Ineligibility for partial benefits

You won’t qualify for any benefits if you’re working full-time, regardless of whether you’re earning a commission or even if your earnings are less than your weekly benefit amount.

Collecting payment

You can collect your weekly UI benefit by filing your weekly claim and reporting your work search activities.

You can choose how to receive your payments: either by direct deposit into a U.S. bank account or through a Key2Benefits prepaid Mastercard. You can make this selection in your Uplink Claimant Self-Service account. To set up direct deposit, you will need to provide your bank account number and routing number.

Are Indiana unemployment benefits taxable?

Yes, your unemployment benefits count as taxable income. Both federal and state income taxes apply. The Department of Workforce Development will send you an IRS Form 1099-G in late January for tax purposes.

When you first file your unemployment claim through Indiana’s Uplink online system, you can decide to set aside part of your weekly benefit for taxes. Specifically, you can opt to withhold 10% for federal income tax and 4% for state income tax, totaling 14%.

So if your weekly benefit amount is $350 per week, $35 would go to federal tax and $14 to state tax, reducing your weekly payment by $49. Once you choose to withhold taxes, that choice sticks for the whole period of your current unemployment claim, and you can’t change it later.