Georgia Unemployment Eligibility Calculator

Georgia unemployment benefits provide essential financial assistance for many unemployed workers. The program is available to eligible workers who have experienced job loss through no fault of their own.

To determine eligibility, factors such as wages, work search requirements, and suitable work are considered. Georgia unemployment insurance provides a weekly benefit amount to support unemployed workers as they navigate the job market. By understanding the eligibility requirements, unemployed Georgia workers can get support during times of financial hardship.

How to qualify for Georgia unemployment benefits

Under Georgia law, individuals must fulfill the following criteria to be eligible for unemployment benefits.

- You’ve earned sufficient insured wages

- You’re unemployed due to no fault of your own

- You are able to work

- You are available to work

- You are actively searching for suitable work

- You are a United States citizen or authorized to work in the state of Georgia

Wage Requirements

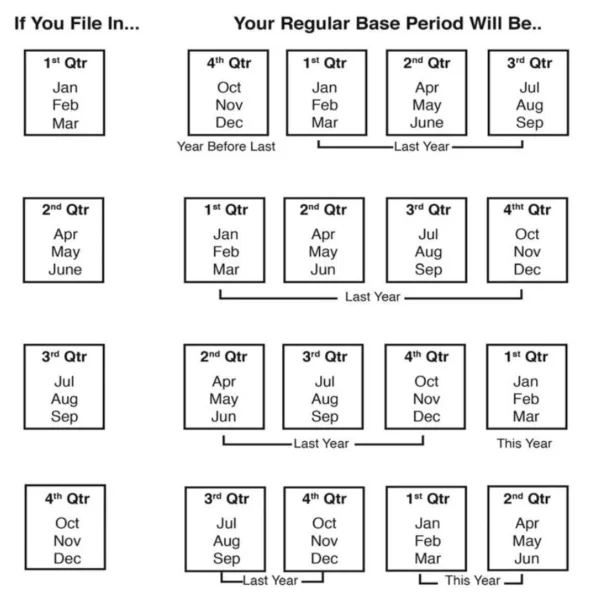

To qualify for benefits, you must have earned enough insured wages during the base period. The regular base period includes the first four of the last five completed calendar quarters when you file your claim.

Base Period

If your claim can’t be established with the regular base period, the alternative base period will be used, which consists of the last four completed calendar quarters when you file your claim.

To meet the wage requirements, you must:

- Have insured wages in at least two quarters of the base period

- Earn at least $1,134 in the two highest quarters in the base period

- Have total insured wages during the base period equal to at least one and one-half times your highest quarter of earnings

Alternate Calculation

If the only reason you don’t qualify for benefits is that your total wages aren’t equal to one and one-half times the highest quarter of wages, an Alternate Calculation will be used. With the Alternate Calculation, your weekly benefit amount is calculated by dividing the highest quarter of wages by 21. You must have wages earned in at least two quarters of the base period, and your total wages must be at least 40 times the weekly benefit amount.

At present, the minimum WBA is $55, and the maximum WBA is $365. You can estimate your weekly benefit amount using the Georgia unemployment calculator.

Work Requirements

To receive benefits, you must be able, available, and actively looking for work. You’ll need to provide proof that you’re searching for work when you file your weekly claim. You are required to seek and accept all suitable work.

To meet work availability and work search requirements, you must:

- Register for Employment Services through Employ Georgia.

- Be physically able to perform work, even if it’s not in your regular field.

- Be available to work.

- Actively search for suitable work each week

- Complete verifiable job search activities on three or more days each week.

- Keep detailed records of your work search activities.

- Accept all referrals from the GDOL for suitable work.

- Accept all offers of suitable work from employers.

- When filing your weekly claim, report any job offer refusals – even if you believe the work was not suitable.

- Report to your local Career Center when instructed by the GDOL.

To receive benefits, you must meet all availability and work search requirements each week. Your work search record may be subject to random audits by the GDOL at any time.

You will be denied benefits for any week when you don’t meet these requirements. It’s important to be completely honest and provide full information. If you make false statements or misrepresent facts, that is considered Georgia unemployment fraud. You’ll be responsible for repaying benefits and may be subject to fines and criminal charges.

Employ Georgia

Registering with Employ Georgia is necessary for all individuals requesting unemployment benefits. The registration process includes setting up an account, which must include your Social Security number. You will be asked to upload a resume and make it searchable by employers.

Your Employ Georgia account will become inactive after 6 months. If your account becomes inactive, you can reactivate it and renew your employment services registration by simply logging in at employgeorgia.com.

Job Separation

Your eligibility to receive benefits is based on the reason you separated from your most recent employer. Your former employer will be contacted to verify the reason for your job separation.

You must be unemployed through no fault of your own. This means that you are disqualified if you were fired for misconduct or if you quit without good cause.

Can I quit my job and still qualify for UI benefits?

If you quit your job, you might still be eligible for benefits if you can demonstrate that you left due to a valid work-related reason. “Good cause” reasons may include significant changes in working conditions, alterations in the work agreement, nonpayment for work, a hostile work environment, and similar issues. However, if your reason for quitting was personal, even if it was a strong or compelling reason, you won’t be able to draw benefits.

The only way to determine your eligibility is to apply for Georgia unemployment benefits. The department cannot predetermine your eligibility before a claim is filed.

What if I got fired?

If you were fired from your job, you may not be able to receive benefits. Your former employer must demonstrate that you were dismissed for failing to follow rules, orders, or instructions, or due to misconduct at work. You should apply for UI benefits so the GDOL can make an official determination.

Suitable Work

You must be willing to accept work that is similar to your last job, as long as there is a reasonable expectation of obtaining that type of work.

The suitability of a job depends on the duration of your unemployment. As your unemployment period increases, you are expected to adjust your employment expectations regarding earnings, working conditions, job duties, and prior training or experience.

After 10 weeks of collecting benefits, you must be willing to accept an hourly wage that is at least 66% of the average hourly wage you earned during the highest quarter of your base period.

However, the new hourly wage must be at least the minimum wage established by state and federal law. Failure to apply for suitable work could result in a loss of benefits and/or repayment of benefits you’ve already received.

Refusing a job offer

When the Georgia Department of Labor (GDOL) refers you to suitable work or an employer offers you suitable work, you must apply for the job as instructed or accept the job offer.

If you refuse to accept suitable work, you must report your refusal to the GDOL when requesting your weekly payment. GDOL will determine if there was good cause to refuse the work.

Here are some examples of when you are allowed to refuse a job offer:

- The position became available due to a strike.

- The job paid less than minimum wage.

- The wages were substantially lower than prevailing wages for similar work in the area.

- You would be required to join a union or resign from a union as a condition of hire.

The GDOL will determine whether the reason for your job separation meets the requirements for unemployment insurance benefits.

Eligibility Determination

The Georgia Department of Labor (GDOL) will assess your application for benefits and make two determinations regarding your claim:

- Unemployment Insurance Benefit Determination

- Claims Examiner’s Determination

The first determination informs you whether you have enough insured wages to establish a valid claim. The letter will include information about your base period wages, potential weekly benefit amount, and the number of weeks you can potentially receive benefits.

How long will benefits last?

Currently, you can receive benefits for up to 26 weeks. Sometimes, State Extended Benefits (SEB) are available when the unemployment rate is too high. When there is a natural disaster, you may be eligible for Disaster Unemployment Assistance.

Expired programs that were helpful during the COVID pandemic include Federal Pandemic Unemployment Compensation (FPUC), Pandemic Emergency Unemployment Compensation (PEUC), and Pandemic Unemployment Assistance (PUA). These benefit programs ended in 2021.

If you think the wages shown on your determination letter are incorrect or incomplete, you can request that your claim be reconsidered. A request for reconsideration of wages must be submitted in writing to your career center within 15 days of the date on the Unemployment Insurance Benefit Determination.

Currently, the minimum benefit amount is $55, and the maximum benefit amount is $365.

For claims filed between July 1 and December 31, Georgia uses the seasonally adjusted Unemployment Insurance (UI) rate from the previous April. For claims filed between January 1 and June 30, Georgia uses the seasonally adjusted UI rate from the previous October. Check the Maximum Unemployment Benefits chart for additional details.

| Determination of the Maximum Benefit Period | |

| Unemployment Rate Adjusted seasonally | Maximum Number of Weeks |

| Less than or equal to 4.5% | 14 weeks |

| Greater than 4.5%, up to 5.0% | 15 weeks |

| Greater than 5.0%, up to 5.5% | 16 weeks |

| Greater than 5.5%, up to 6.0% | 17 weeks |

| Greater than 6.0%, up to 6.5% | 18 weeks |

| Greater than 6.5%, up to 7.00% | 19 weeks |

| Greater than 7.0%, up to 7.5% | 20 weeks |

| Greater than 7.5%, up to 8.0% | 21 weeks |

| Greater than 8.0%, up to 8.5% | 22 weeks |

| Greater than 8.5%, up to 9.0% | 23 weeks |

| Greater than 9.0%, up to 9.5% | 24 weeks |

| Greater than 9.5%, up to 10.0% | 25 weeks |

| 10% or above | 26 weeks |

Claims Examiner’s Determination

You will receive a determination notifying you if you qualify for unemployment benefits based on your reason for job separation, your availability for work, and other eligibility requirements under Georgia law.

It can take up to 21 days to receive the Claims Examiner’s Determination.

If you are disqualified

If you are deemed ineligible for benefits, you can file an appeal. You have 15 days from the notification date to request an appeal. Be sure to keep filing weekly claims during the appeal process. This way you can collect back pay if you win your appeal. Read our Georgia UI Appeals Guide to learn more.

Comments are closed.