A common question that haunts unemployed individuals, especially the retired ones is whether or not they can claim Unemployment Compensation along with Social Security Retirement benefits. As you may know, this program offers people with a weekly benefit amount to provide financial assistance while they don’t have a major or stable source of income.

All applicants for UI are required to satisfy certain criteria, out of which one is that the claimant should have zero or negligible income. This is the reason why most people wonder whether receiving social security retirement benefits will raise your income to the earnings ceiling as stated by the rules of UI.

Can UC be collected along with social security retirement benefits and vice versa?

The answer is – Yes, in most cases. There are two reasons behind this. If your question is whether social security benefits will be hindered by receiving UC, then you can be rest assured. Receiving UC will never affect your social security retirement benefits because social security does not consider UC as earnings. This means that won’t be pushed closer to the ceiling placed as cut off for people between ages 62 – 66.

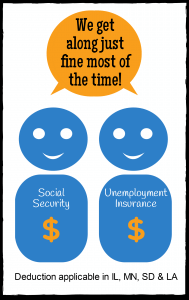

If your worry is about UC being affected because you receive social security retirement benefits, then here’s what you need to know. Typically, most states in the US will not reduce UI benefits because you are claiming social security retirement benefits. However, as UI is given out by the state government, it varies from state to state. Following are the list of states that take social security benefits into consideration and reduce the benefit amount while providing UC –

- Illinois

- Louisiana

- Minnesota

- South Dakota

Will Illinois, Louisiana, Minnesota and South Dakota change UC rules in the near future?

Yes, there is hope. Even now in Minnesota, the rules don’t apply always. Which means that the state does not reduce UI benefit amounts in all cases where a claimant is receiving social security retirement benefits. Since the last few years, American Association of Retired Persons (A.A.R.P) and National Employment Law Project (N.E.L.P) have been working together to persuade the states to remove laws that limit UC benefits for individuals receiving social security.

Whom should I approach if I have any questions?

Irrespective of which state you are from, if you have any queries regarding anything with unemployment compensation, your state’s Unemployment Insurance Agency is where you need to go. Authorities present there will guide you through the process of filing for UI and will gladly clear your questions. You can also interact with them by phone on the dedicated customer service or you can connect with them online.

Keep in mind that not declaring your income sources while filing for UI or not reporting any income you receive during subsequent weeks during which you receive benefits, may result in severe consequences.

Things to keep in mind

Unemployment insurance is a social welfare program conducted jointly by the state and federal governments. The idea to provide temporary financial assistance to those who really need it. While there is no conflict in collecting both UC and Social Security, it is vital that you continue to fulfill the eligibility criteria laid down by the UC rules. And one of those rules is that you actively seek new job opportunities. If you are indisposed to work further, you may not be able to claim UI. Speak with your agency. They will guide and advise you on all matters related to UC.

The bottom line

As long as both agencies are notified about the income received from each other, there is no conflict in collecting UI and social security together. It is a sad truth that during difficult economic times, often millions of senior citizens are left unemployed and often social security benefits are not sufficient to cover the basic needs.

Remember, you can collect UC only if you satisfy all the rules, including base period wages. You can read more about UC eligibility criteria to know more. Alternately, you can also make use of the eligibility checker tool, to get an idea of whether or not you will qualify for UC. The UC filing process is quite easy and can be done online.

People who fall into this category often feel that they are too young to be retired and sitting at home yet too old to be hired. While this is not always true, tedious working hours may no longer agree with you. Hence, it’s an ideal time to start a small business of your own, something that gives you joy. You could also use this time to connect with loved ones who were ignored by you in your better (read hectic) days. Stay positive and confident.