For residents of Texas out of work, unemployment compensation can help get them by until they’re on their feet again. But there are certain requirements that must be met in order to collect unemployment benefits in Texas.

Texas Unemployment Eligibility Calculator

3 Eligibility Requirements for Texas Unemployment Compensation

- Past Wages

- Job Separation

- Ongoing Eligibility Requirements

Past Wages

Monetary Requirements

Your past wages will determine your Weekly Benefit Amount (WBA), which will be anywhere between $72 and $563. To find the exact dollar amount that a potential benefits claimant will be receiving, the Texas Workforce Commission will take their highest earning quarter in the base year (more on that later) and divide the total gross wages for the quarter by 25.

Maximum Benefit Amounts

In order to know the maximum amount of benefits you can collect, you’ll need to first look at a Texas Unemployment Calculator and see how much you’re going to collect per week. The maximum benefit amount (MBA) that you can collect in total is 26 times that number, or 27% of your quarterly wages in your highest earning quarter in the base year—whichever is less. This maximum amount applies to a 52 week year beginning the Sunday you started collecting benefits. As of 2022, the minimum amount of benefits one will collect per week is $72 and the absolute maximum amount is $563.

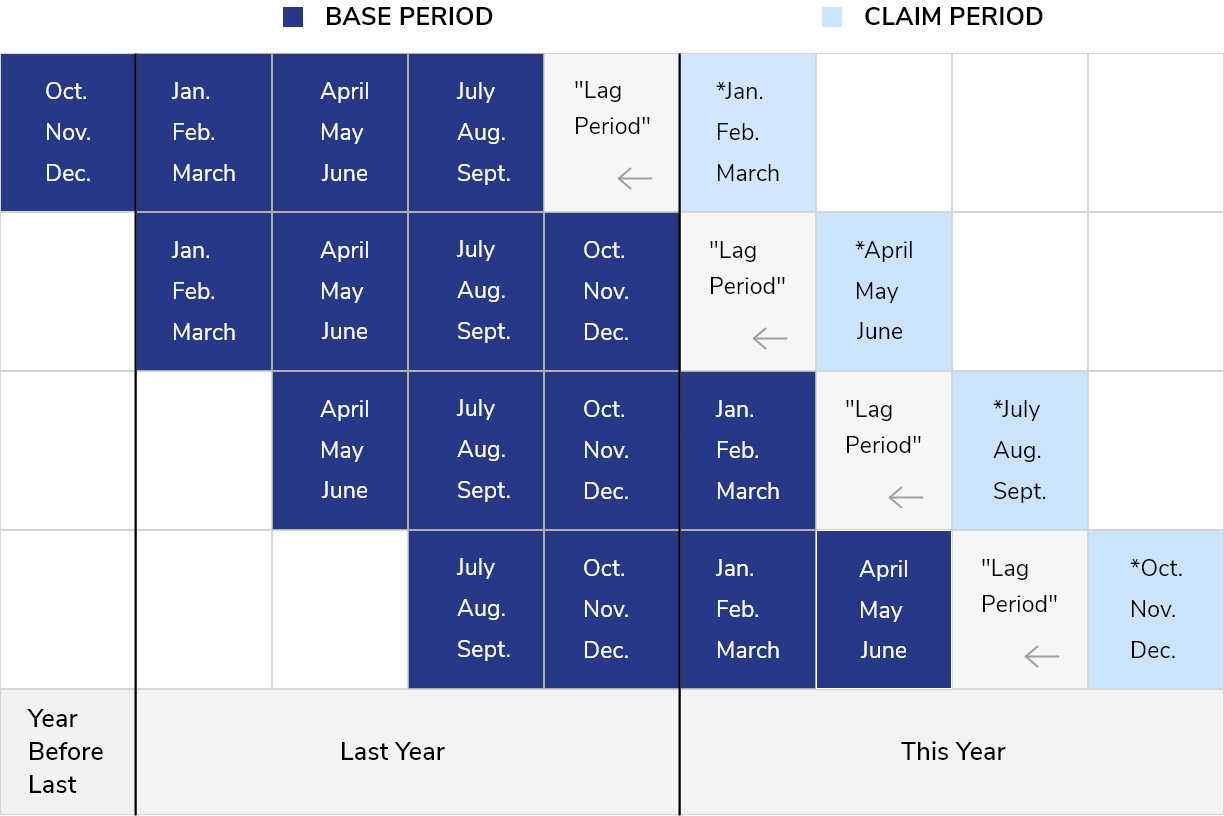

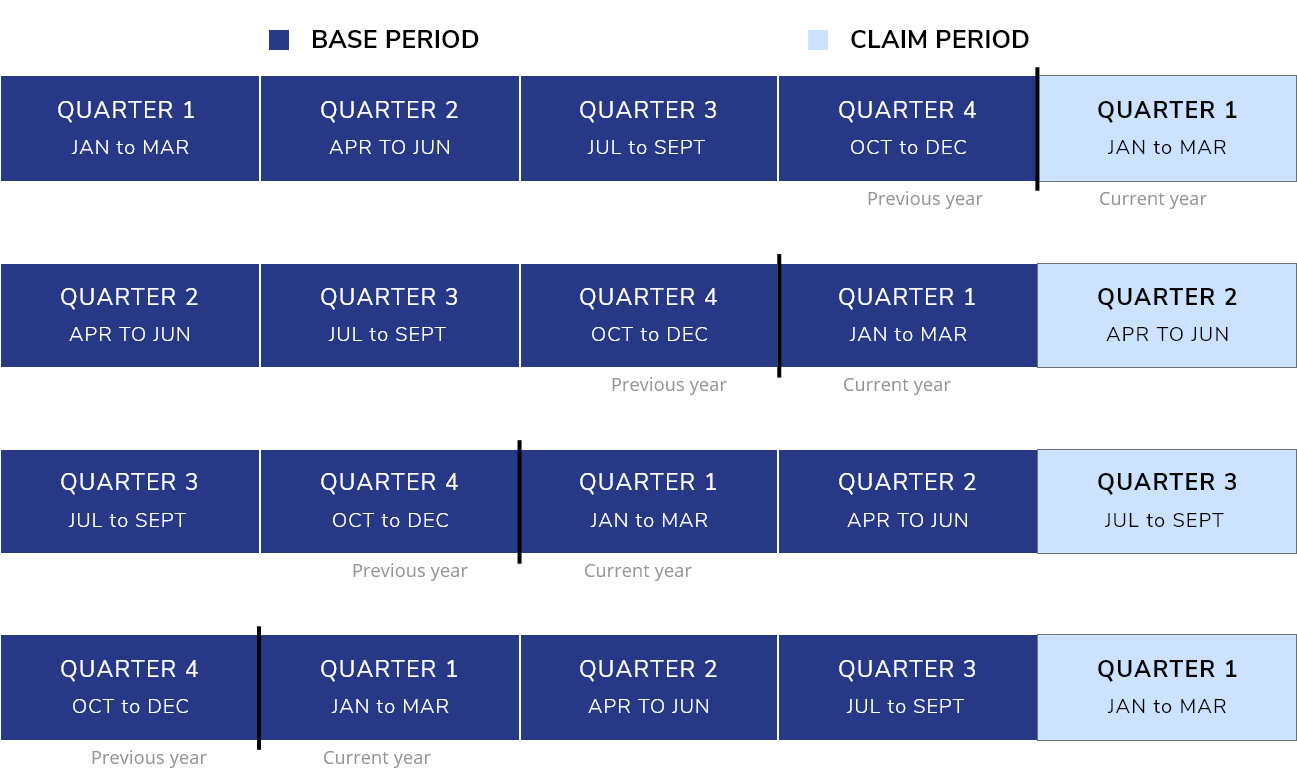

Texas Unemployment Base Period

The base period is important for determining your WBA (weekly benefit amount). It comprises the first four calendar quarters of the last five complete quarters before you filed for unemployment. The effective date for this calculation is not the actual day you apply, but the Sunday of that week.

This leads to some additional requirements:

- You must have collected wages in at least one of those quarters

- You must have earned at least 37 times your weekly benefit amount during the entire base period

- If you previously collected unemployment, you must have earned at least six times your new WBA

Texas Unemployment Alternate Base Period

The above is the standard base period. The state includes another type of base period known as the alternate base period. This type of base period will be considered if you are out of work for a longer duration due to injury, pregnancy, or other medical illnesses.

If you were out of work for seven weeks or more because of an injury, disability, illness, or pregnancy, you can use something called an alternate base period. The alternate base period will allow the TWC to look at wages paid before your forced medical leave, as long as you file your initial claim no more than 24 weeks after the condition started or your pregnancy began. You will need this all to be verified by a medical professional such as a doctor.

Note – The TWC does not use the quarter in which you apply for benefits or the quarter before that. Instead, it will use the 1-year period before the two quarters. Also, the effective date will be the Sunday of the week in which you file the claim.

Job Separation

To be eligible for Texas unemployment, you also need to be out of work or have your hours reduced through no fault of your own. That excludes situations where you were fired or had your hours cut back because of gross negligence or willful misconduct.

Types of Job Separation

Laid off

Employers engage in layoffs when there is a lack of work or money, not through any fault of the employees. That said, a layoff will make you eligible for benefits.

Working Reduced Hours

A lack of work or money might also lead an employer to reduce your hours. As long as it was not initiated by your request or part of a disciplinary action, this can qualify you for benefits.

Fired

If you were terminated from your job completely, you can collect benefits. This includes a demand for your resignation. However, if you violated company policy, broke the law, neglected your duties, mismanaged your position, or failed to perform your work despite your capability of doing so, you may be denied benefits.

Examples of misconduct include:

- Mismanagement of your position

- Violation of law or company policy

- Failure to perform your duties adequately

Quit

If you quit your job for personal reasons like you just didn’t like the job or you couldn’t find childcare, you cannot collect unemployment. However, if you quit because of reasons like…unsafe working conditions, sexual harassment, withheld payment, and material changes to your job description, you can collect unemployment.

You can also collect if you quit for personal reasons that are beyond your control, such as the need to care for a sick dependent (child or spouse), you got injured or sick, or sexual assault, you can also collect unemployment. You can also collect if you have to quit your job to move with your military spouse, or if you begin Commission-Approved Training and your job is no longer considered suitable for you.

Labor Dispute

You may be able to collect unemployment if you were part of a labor dispute. Your best bet here is to quickly consult with a labor lawyer.

If you meet all the state-defined eligibility requirements, you may qualify for UI benefits in Texas. The TWC will mail a statement after four weeks of your application that includes details about your potential benefits (Weekly Benefit Amount or WBA and Maximum Benefit Amount or MBA).

Ongoing Eligibility Requirements

To maintain eligibility for unemployment benefits in Texas, there are some additional ongoing requirements:

- Be able and willing to work full time

- Look for work and participate in work search activities (unless given an exemption)

- File your biweekly claim

Remember that while collecting unemployment insurance benefits, you need to be looking for work. This job search requirement means registering on the WorkInTexas website. You must be willing and able to work full time. As a side note, if you are not able to work because of a condition or illness that prevents you from holding gainful employment, you should look at collecting Social Security Disability Insurance. And if this condition or illness occurred because of your last job, you should explore workers’ compensation insurance.

Texas Workforce Solutions has a number of locations around the state where those collecting unemployment assistance can get help finding suitable work. These workforce solutions office locations where those collecting UI benefits can get one-on-one help creating a resume and applying for jobs, or locating good sources of vocational rehabilitation.

In most counties, you will need to apply for three jobs each week, but exceptions include some that only require one, and others that require as many as five applications. You will need to keep records of your job search activities, because the TWC may request these records any time during the time period in which you’re collecting unemployment.

If you are temporarily laid off with a promise from your employer of future employment, are part of a union with a hiring hall (and you’re in good standing), or engaged in a TWC-approved training program, you do not have to conduct a job search while collecting Texas unemployment benefits.

Your previous job experience, training, and qualifications will inform what type of job is suitable for you to apply to. Jobs should have similar pay and working conditions to the jobs you have previously held. You do not have to apply for jobs that are far away from home, that is, outside normal commuting patterns of behavior.

You do not have to apply to any jobs that compromise your health, safety, or morality. In terms of pay, during the first 8 weeks that you collect unemployment, you must accept suitable work that pays 90% or more of your previous salary. After that, the Texas Labor Code states you must accept work paying 75% of your previous salary.

Temporary unemployment benefits are meant to be just that…temporary. If the TWC determines you are not putting in effort toward an honest job search—for example, applying for jobs you aren’t qualified for or turning down jobs that are comparable to your previous work—you could lose your Texas unemployment benefits.

Another ongoing eligibility requirement in Texas is to file your unemployment claims on time every two weeks, either online or by phone. If you miss filing an unemployment claim for that time period, your unemployment insurance may be delayed or denied for those two weeks.

If your unemployment benefits are exhausted and you still have not found work, contact Texas Workforce Solutions about job training and reemployment options.

Eligibility Questions

Can I collect unemployment if I am fired?

You can obtain unemployment benefits if you were fired without work-related misconduct.

Examples of misconduct are:

- violation of company policy

- violation of law

- neglect or mismanagement of your position

- failure to perform your work acceptably if you are capable of doing so

Upon getting fired, the ex-employee can file for unemployment benefits. Whether he gets it depends upon the situations of the firing. If the unemployment board grants unemployment, the employer has the right to appeal the decision and to show evidence why the unemployment benefits are not warranted.

In Texas, if an employee is fired due to misconduct, the employer will need to show documentation to support his case at an unemployment hearing.

Can I draw unemployment benefits if I quit?

You can collect unemployment benefits if you quit your job for a good well-documented work-related or medical reason. You should be ready to present proof that you tried to correct the problem before you quit.

TWC (Texas Workforce Commission) may rule good cause if the work situation would cause a person who truly wants to keep the job to leave it.

Examples of possible good cause are:

- Unsafe working conditions

- Significant change in hiring agreement

- not receiving payment for your work

Examples of medical reasons are

- Quitting on your doctor’s advice, or

- Quitting to provide care for a minor child who has a medically verifiable illness if there is no alternative care provider, or

- Quitting to provide care for a terminally ill spouse if there is no alternative care provider.

You can also collect unemployment benefits if:

You quit to protect yourself from family violence or stalking, evidenced by an active or recently issued protective order, a police record documenting family violence or stalking directed against you, or medical documentation of family violence against you.

In addition:

If you quit to move with your husband or wife, you may be able to receive benefits after a disqualification of 6 to 25 weeks. This is a disqualification of both time and money, because the unemployment office must subtract the number of weeks from your total benefits.

If you quit to move with your military spouse, Texas lets you collect benefits without a disqualification if your spouse has a permanent change of station longer than 120 days, or a tour of duty longer than one year.

Can I obtain benefits if I am laid off?

Texas entitles you for unemployment benefits if you are laid off due to lack of work.

When you get laid off, it is not your fault. In almost all cases, this means that if you get laid-off, you are qualified to obtain unemployment benefits.

You should immediately apply for unemployment benefits if you get laid off. Getting laid off simply means that you left job through no fault of your own and the company did not have enough work for you and could no longer pay for the job.

Want to know about how much you will receive?? —–> Calculate Benefits

Comments are closed.