The Idaho unemployment calculator is a great tool that can help unemployed workers figure out how much money they are eligible to receive each week from Idaho unemployment insurance.

It’s important to keep in mind that this tool is only an estimate—it’s not a guarantee of benefits.

Idaho Unemployment Benefits Calculator

How are Idaho unemployment benefits calculated?

Your weekly benefit amount is calculated by taking the highest earning quarter of your base period and dividing it by 26. However, no matter how much you earned, you cannot receive more than $532, which is the highest amount allowed by law as of 2023.

For example, if you earned $10,000 during your highest earning quarter, your weekly benefit amount would be $384. If your highest quarter wages were $12,500, your weekly benefit amount would be $480.

More examples:

- If you make $300 per week in Idaho, your estimated weekly benefit is $150 for up to 26 weeks.

- If you make $400 per week in Idaho, your estimated weekly benefit is $200 for up to 26 weeks.

- If you make $800 per week in Idaho, your estimated weekly benefit is $400 for up to 26 weeks.

- If you make $1000 per week in Idaho, your estimated weekly benefit is $500 for up to 26 weeks.

- If you make $1500 per week in Idaho, your estimated weekly benefit is $532 for up to 26 weeks.

How many weeks do I get Idaho unemployment benefits?

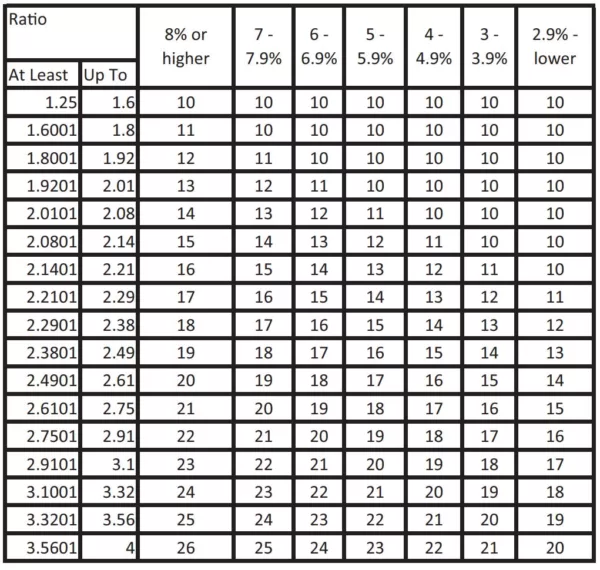

The number of weeks you qualify for depends on how much you earned and Idaho’s current unemployment rate. You could receive benefits for anywhere between 10 to 26 weeks.

In order to calculate how many weeks of Idaho unemployment benefits you’re eligible for, you first need to calculate your ratio. You can do this by dividing your total base period wages by the wages earned in your highest quarter. Once you have your ratio, you will compare it to Idaho’s average unemployment rate.

For example, if your ratio is 2.5 and Idaho’s unemployment rate is 3%, you would qualify for 16 weeks of unemployment benefits.

What is a base period?

In Idaho, the base period is the first four of the last five working quarters before the week you file your unemployment claim.

For example, if you filed your claim in May 2023, the base period would be from January 1, 2022, to December 31, 2022.

The base period is used to calculate an individual’s monetary eligibility and weekly benefit amount.

If you aren’t eligible for unemployment benefits under the regular base period, the Idaho Department of Labor will sometimes use an alternate base period to qualify you. The alternate base period is the last four quarters you worked before filing.

Are Extended Benefits available?

Currently, there are no Extended Benefits programs available in Idaho for unemployment. Idaho unemployed workers are eligible for 10 to 26 weeks of benefits, depending on previous earnings and the state’s average unemployment rate.

Can I work part time and receive benefits?

Yes, you can work part-time and receive benefits. However, you cannot earn more than 1.5 times your weekly benefit amount, and you must continue to meet the state’s work search requirements to find a full time job.

Can child support be deducted from unemployment benefits?

Yes, child support payments can be deducted from your UI benefits. For more information about how this works, call the Idaho Department of Health and Welfare Child Support Services at (800) 356-9868.

How do I get paid?

You can choose to have your unemployment compensation directly deposited into your bank account or you can opt to receive a bank card. If you don’t sign up for direct deposit, a bank card will be mailed to you seven to 10 days after filing your initial application for unemployment benefits.

What if I filed my weekly claim but didn’t receive payment?

You can check to see if a payment has been processed by checking the iUS Claimant Portal. If the system says that a payment has been sent, but you haven’t received it yet, you will need to call the unemployment insurance claims center.

Are unemployment benefits taxable income?

If you receive unemployment insurance benefits, you have to pay taxes on them. You can choose to have 10% of your payments held back for federal taxes, but the Idaho Department of Labor cannot withhold money to pay the state income tax, so you will need to plan accordingly.

At the end of January, you will receive form 1099-G in the mail. You will need this form to do your tax return.