Unemployment compensation can help unemployed workers with temporary assistance until they can find a new job. But before applying for unemployment benefits, it helps to use the Colorado unemployment calculator to see your benefit amount. You will want to make sure you are collecting the maximum weekly benefit you can collect based on your previous wages and earnings, provided you meet Colorado unemployment eligibility requirements.

Calculate your estimated Colorado unemployment benefit by entering your quarterly wages earned below:

This free calculator tool can help you estimate your Colorado unemployment benefits. Please note that the information provided is not a guarantee of benefits.

Colorado Unemployment Benefits Calculator

To estimate your Colorado unemployment payments using the calculator, simply put in the total wages you earned during each quarter, and your weekly benefit amount will be displayed. When filing your initial application, you will receive a monetary determination letter in the mail. If the benefit amount on that letter differs from the amount you have seen on the calculator, you should immediately file an appeal, and continue filing your weekly benefit claim in case you are awarded additional back benefits.

Example Calculations:

- If you make $400 per week in Colorado, your estimated weekly benefit is $240 for up to 26 weeks.

- If you make $500 per week in Colorado, your estimated weekly benefit is $300 for up to 26 weeks.

- If you make $1000 per week in Colorado, your estimated weekly benefit is $600 for up to 26 weeks.

- If you make $1500 per week in Colorado, your estimated weekly benefit is $781 for up to 26 weeks.

- If you make $2000 per week in Colorado, your estimated weekly benefit is $781 for up to 26 weeks.

How are Colorado UI benefits calculated?

Unemployment benefits are based on your gross wages, tips, and earnings during your base period. If you have earned at least $2,500 during this 12-month period, you can receive unemployment insurance payments in the form of a weekly benefit payment or WBA. Unlike some other unemployment departments around the United States, Colorado will allow you to factor in wages earned in other states, as long as you have some wages earned in Colorado.

In the state of Colorado, there are two different formulas to determine what your WBA will be. The WBA that claimants receive will use whatever formula yields a larger number. These formulas are geared toward awarding weekly benefits that come close to 55% of your average weekly wage in your base period.

The first formula takes the total wages paid to you in your two highest consecutive quarters during the base period. The earnings of this six-month period are then divided by 26 and multiplied by 60% to determine your WBA. The minimum you will get is $25, while the maximum is $710. What this formula basically does is provide you with 60% of the weekly income you were getting while you were most successfully employed.

The second formula takes the total wages paid out to you in the entirety of the 12-month base period and then divides that number by 52. This number is then divided in half to determine the WBA. This amount cannot exceed more than $781 per week, but it will at least be $25. In this case, the formula is beneficial for individuals whose earning potential was not so concentrated in one or two calendar quarters.

Let’s put these formulas to work on some actual numbers. Suppose during your base period your two highest earning quarters saw you bringing in a net income of $10,000. Dividing this dollar amount by 26 would yield $384.61, which multiplied by 0.60 yields $231.

Suppose during your base period you earned $30,000 in total. Dividing that dollar amount by 52 would yield $576.92, and dividing that in half would yield $288. Since the second formula yields a higher number, that formula would be used to determine your WBA.

What is the base period?

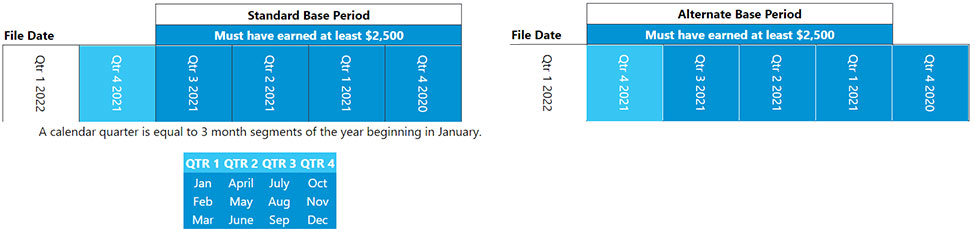

The base period is the first four complete calendar quarters out of the last five complete calendar quarters before the quarter in which you filed for unemployment insurance benefits. If you did not earn $2,500 during this base period, the Colorado Department of Labor and Employment will examine the alternate base period, which is the last four complete calendar quarters before the quarter in which you filed your Colorado unemployment application.

Unlike other states, Colorado does not have additional requirements such as having your entire base period wages be twice the amount of taxable income in your highest quarter, or other such metrics. Even the $2,500 threshold is low compared to other states’ base period requirements.

When you fill out your application or use the Colorado unemployment calculator to compute your possible benefits, you need to report all taxable income, including things like vacation pay and severance. However, you do not need to report government assistance programs like SNAP food stamps. Keep in mind that the taxable wages you need to report when filing your initial application will also need to be reported when filing your weekly claim.

How do I get paid?

There are two ways of receiving the benefits from your Colorado UI weekly claim. One is through direct deposit to your bank account, while the other is a prepaid debit card managed by U.S. Bancorp.

If you file your claim on the MyUI+ system, you can choose either method. But if you file over the phone, it will default to a prepaid debit card. Take note that after you file your initial claim is a one-week period called the waiting week in which no benefits will be paid.

Comments are closed.