The global economic shutdown following the Coronavirus pandemic began with a lot of speculation and fear over the prospective job losses. Three weeks on we have a clearer picture of what is happening and what the future will need in terms of bouncing back from the economic impact. We will take a brief look at how unemployment due to coronavirus is faring and what the likely future holds.

Unemployment Due To Coronavirus At The Moment

The coronavirus pandemic comes after months of job gains and good economic progress. In January alone nonfarm payroll employment rose by 225,000 and similar numbers were seen in February as well.

But now nearly 700,000 jobs previously added, have been wiped out by the global slowdown and precautions being taken in the US. As of now only 41 US states have issued lockdown orders, so more claim numbers can be expected if this situation worsens and all states adopt lockdowns.

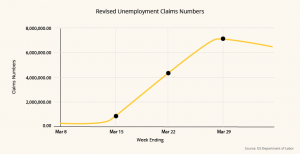

Over 16 million unemployment claims were filed in the last 3 weeks, though not all of them are by people who have officially lost a job. The government has relaxed UI rules to accommodate those having reduced or no pay and the self-employed.

The last time in recent history that such huge job losses occurred was from 2008-10, when over 8 million jobs were lost, during the Global Financial Crisis. But this present scenario shows US history’s fastest job losses.

The largest contributors to unemployment vary across states, but the following sectors have seen the biggest losses:

- Accommodation and Food Services

- Construction

- Manufacturing

- Arts and Entertainment

Retail Trade has had a mixed response with some establishments doing well due to their supply of essential goods.

Coronavirus Deaths And Unemployment

The COVID-19 was not initially seen as a terrifying disease but that soon changed as the mortality grew, all over the world. Quite a few senators have ended up sick, though those who can afford good healthcare have made a recovery.

This is what’s causing the fears that have spurred global shutdowns. Most people have family and friends who would be susceptible to the disease. New York alone has already seen more than 7000 deaths.

Even without shutdowns, a recession-like situation was bound to happen, as people stay home to avoid spreading the virus. Once certain economic sectors begin to collapse, they take others down due to the interconnected nature of the economy. No job is truly recession-proof.

Lessons from Spanish flu: Disease and Unemployment

Coronavirus is not the world’s first pandemic. The last time a disease spread as wide, was the Spanish flu. It ravaged the world for more than a year from 1918-20 and killed off a quarter of the world’s population, while it was still reeling from World War I.

Although the shutdowns may cause some shocks and pain now, the Spanish flu era shows that cities that made earlier and aggressive preventive interventions had a quicker return rate to normal economic activity. Disease always reduces a population’s productivity, hence striving to maintain it provides a more capable population.

What The Future Entails

Some economists think that the Coronavirus pandemic could go away with tremendous job gains, once the labor market fully revives. They liken it to the 1981-82 recession when the short-term recession caused short term layoffs but workers were later rehired.

Others are not so optimistic. It’s likely that Americans would be afraid of future infections following this pandemic and would start saving, especially if a vaccine is slow to develop. They may not frequent restaurants to the pre-coronavirus extents or shop as much, keeping demand suppressed.

Under such situations, a string of bank loan defaults are likely and may push economic recovery lower. Lenders will not have the confidence to support economic growth.

Wait and watch is the only approach we can take during these hard times. The best option for all of us is to follow the physical and social distancing measures and support the country in fighting this pandemic. Fortunately, the government is taking care of Americans in the short run with stimulus checks and UI benefits. Be sure to file yours if you stop receiving pay.

Comments are closed.